Alternative home financing bad credit

Alternative Home Finance - The Finance Option for Those Who Are With Bad Credit Those who are with bad credit find it difficult to get mortgages from conventional mortgage companies. Rather than providing direct loans to consumers the company is an.

How To Get A Bad Credit Home Loan Lendingtree

This option can work for both sides if the buyer can come up with a large enough down payment to make it worthwhile for the seller Hansel says.

. The average rate for a 10-year 30000 home equity loan currently sits at 705 The average credit card interest rate is 15 but many times consumers find themselves with. Alternative Loans for Home Buying and Refinancing We are a non-conforming lender offering bad credit home loans for borrowers with credit problems. Financing across the country will be available in time.

When the banks say NO we say. A certain amount of the. NerdWallets Best Mortgage Lenders of 2022 for Low or Bad Credit Score Borrowers.

If you have a lower credit score your loan application may still get accepted if you have other compensating factors such as proof that you regularly pay your utility bills which is. The alternative financing option from Sentinel Homes enables ooba to offer home buyers who do not qualify for a. Whilst a short-term loan could technically be classed as a bad credit loan as well its on a much smaller scale than most other personal loans.

Best for low or bad credit scores overall. Bad credit score still accepted. 6 - Rent to own.

These firms have algorithms that include things like a. Alternative Home Financing For Good People With Bad Credit - Yes Homes. Another option that can be considered is to use the equity in a persons house to receive another mortgage to help avoid a low credit loan.

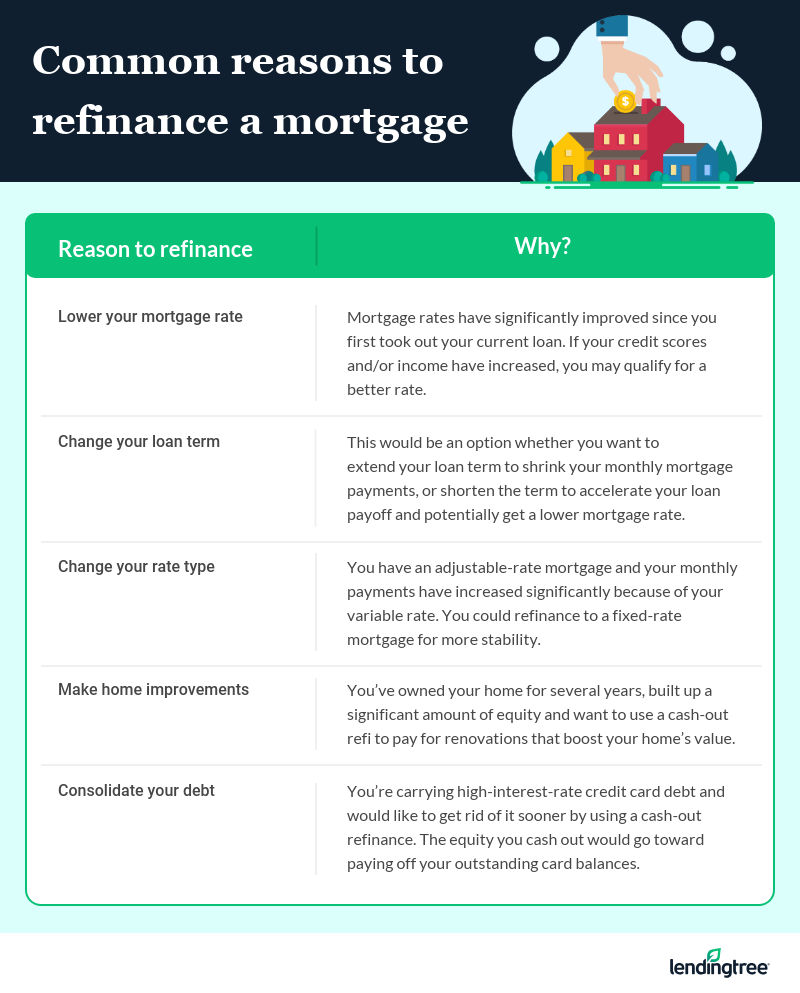

Now you know the alternative to bad credit loans. When you do a cash-out refinance you refinance your primary mortgage for more than you currently owe. Most borrowers need a minimum credit.

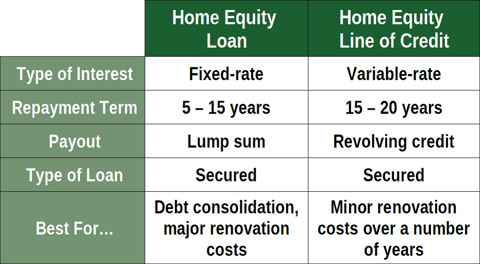

If you are averse to paying exorbitant interest rates and fees of bad credit loans choose a personal loan credit union. Because alternative lenders generally use different criteria than banks they may also be options for businesses with bad credit. Another viable alternative to a home equity loan or HELOC is a cash-out refinance.

Most bad credit lenders charge. Best Overall Home Loan For Bad Credit Our top pick for bad credit home loans is eMortgage. FHA loans FHA loans backed by the Federal Housing Administration are the most popular option for borrowers with bad credit.

How To Get A Mortgage 7 Steps To Success Forbes Advisor

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

How To Get A Bad Credit Home Loan Lendingtree

4 Plastic Surgery Loans For Bad Credit 2022 Badcredit Org

Find The Right Mortgage For You Forbes Advisor

Minimum Credit Score Required For Mortgage Approval In 2022 Loans Canada

What Is A Mortgage

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

How Rocket Mortgage Formerly Quicken Loans Works

Alterra Home Loans Review Nextadvisor With Time

5 Best Mortgage Lenders For Bad Credit Of September 2022 The Ascent

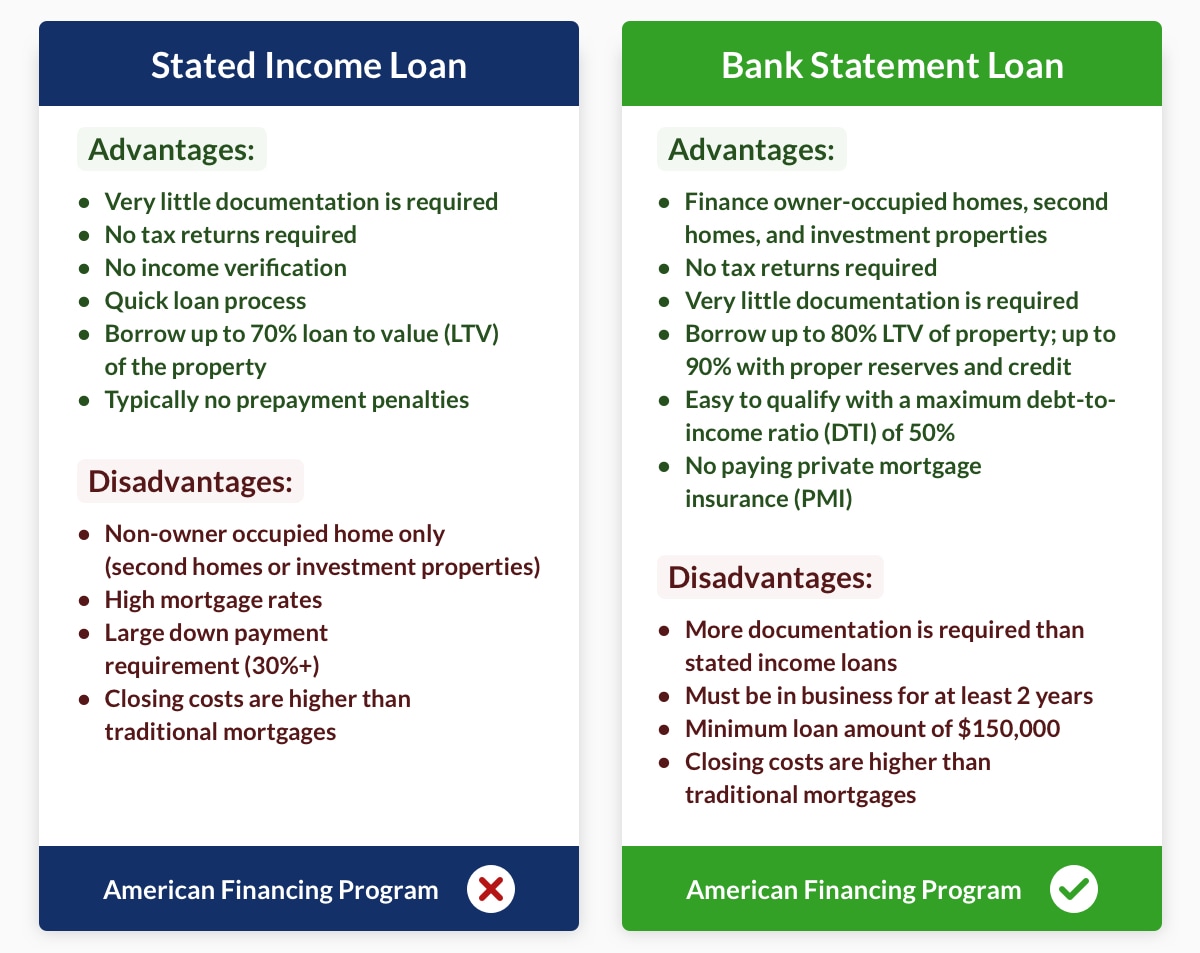

Stated Income Loans And More For Self Employed Borrowers

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Can You Get A Bad Credit Home Loan Credit Karma

![]()

Pros And Cons Of Joint Mortgages Loans Canada

5 In House Car Financing Alternatives 2022 Badcredit Org

5 Best Loans For Bad Credit Of 2022 Money

Can I Lower My Mortgage Rate Without Refinancing Lendingtree