Max 401k contribution 2021 calculator

Ad Discover The Benefits Of A Traditional IRA. Answer A Few Simple Questions To Find Out Which IRA Make Sense For You.

Solo 401k Contribution Limits And Types

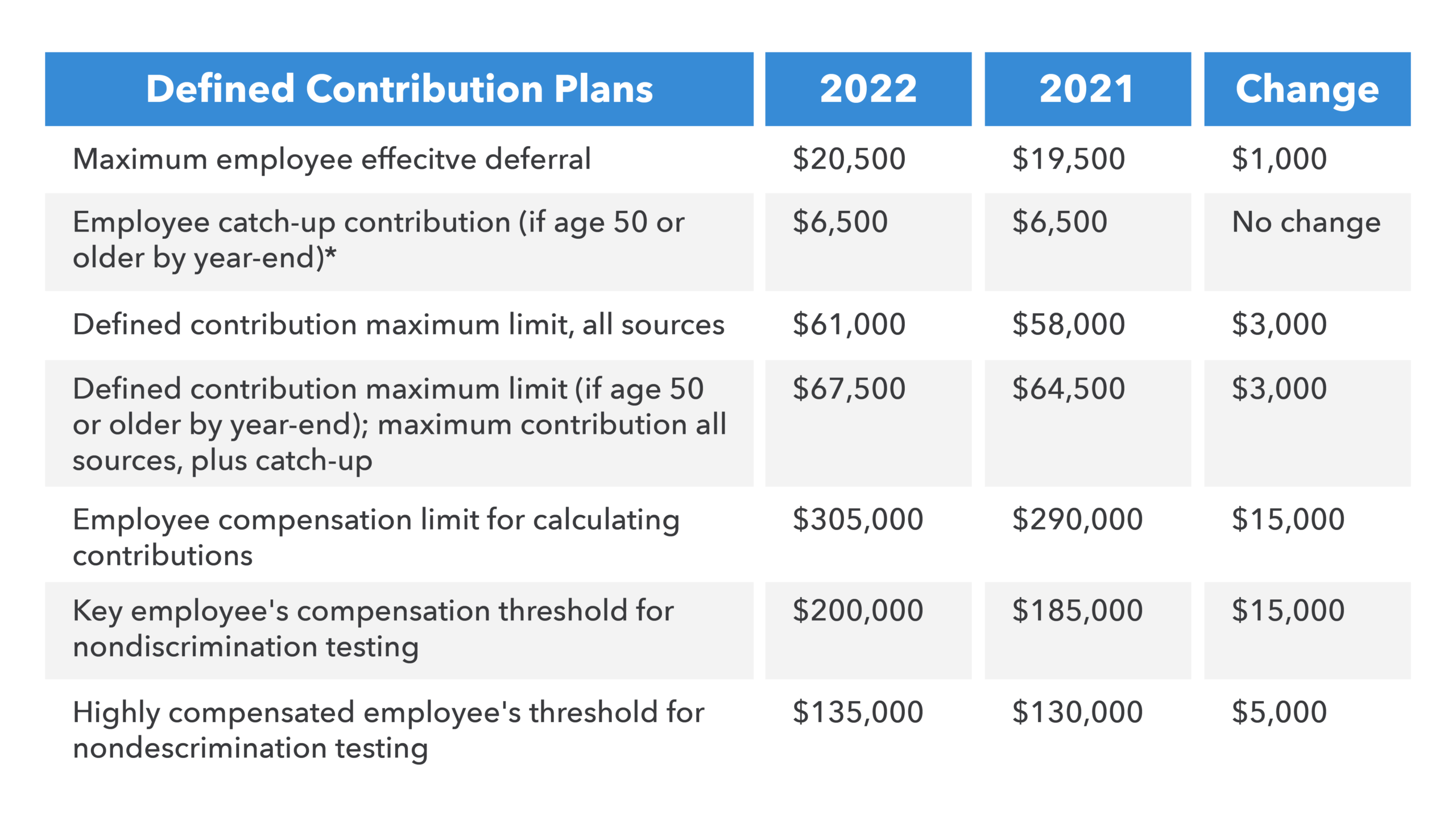

Step 2 Figure out the rate of interest that would be earned.

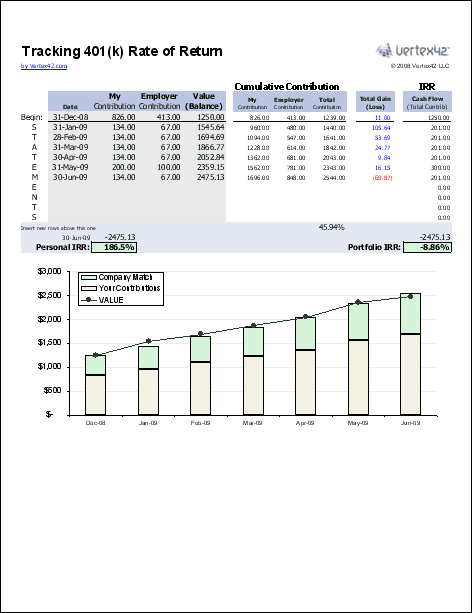

. Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation. A One-Stop Option That Fits Your Retirement Timeline. The 401k contribution limit for 2022 is 20500.

First all contributions and earnings to your 401 k are tax deferred. This is especially the case for people approaching retirement age. Before the beginning of the year the IRS made updates to contribution limits for 2022.

In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can. It provides you with two important advantages. Get the latest numbers here.

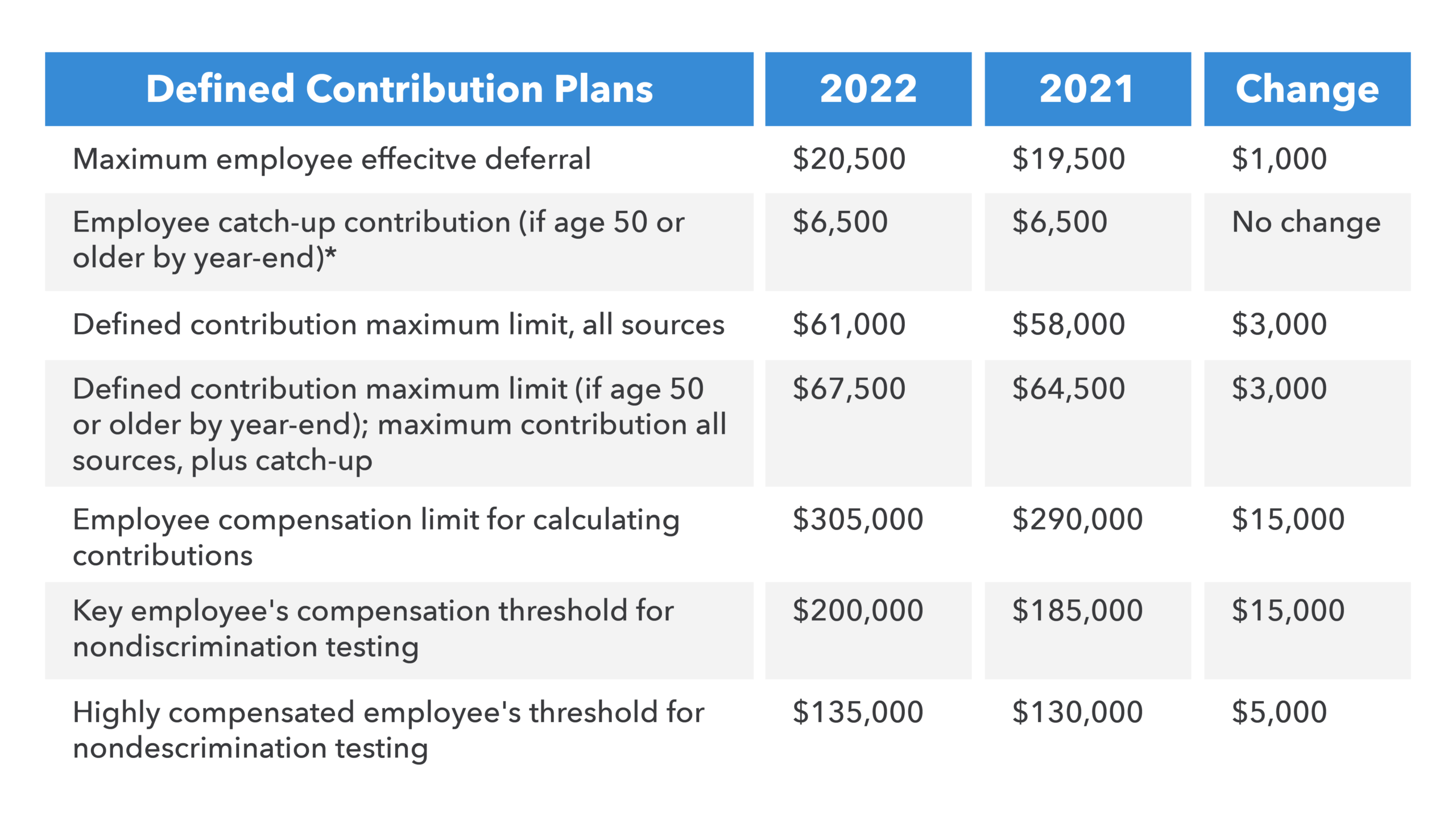

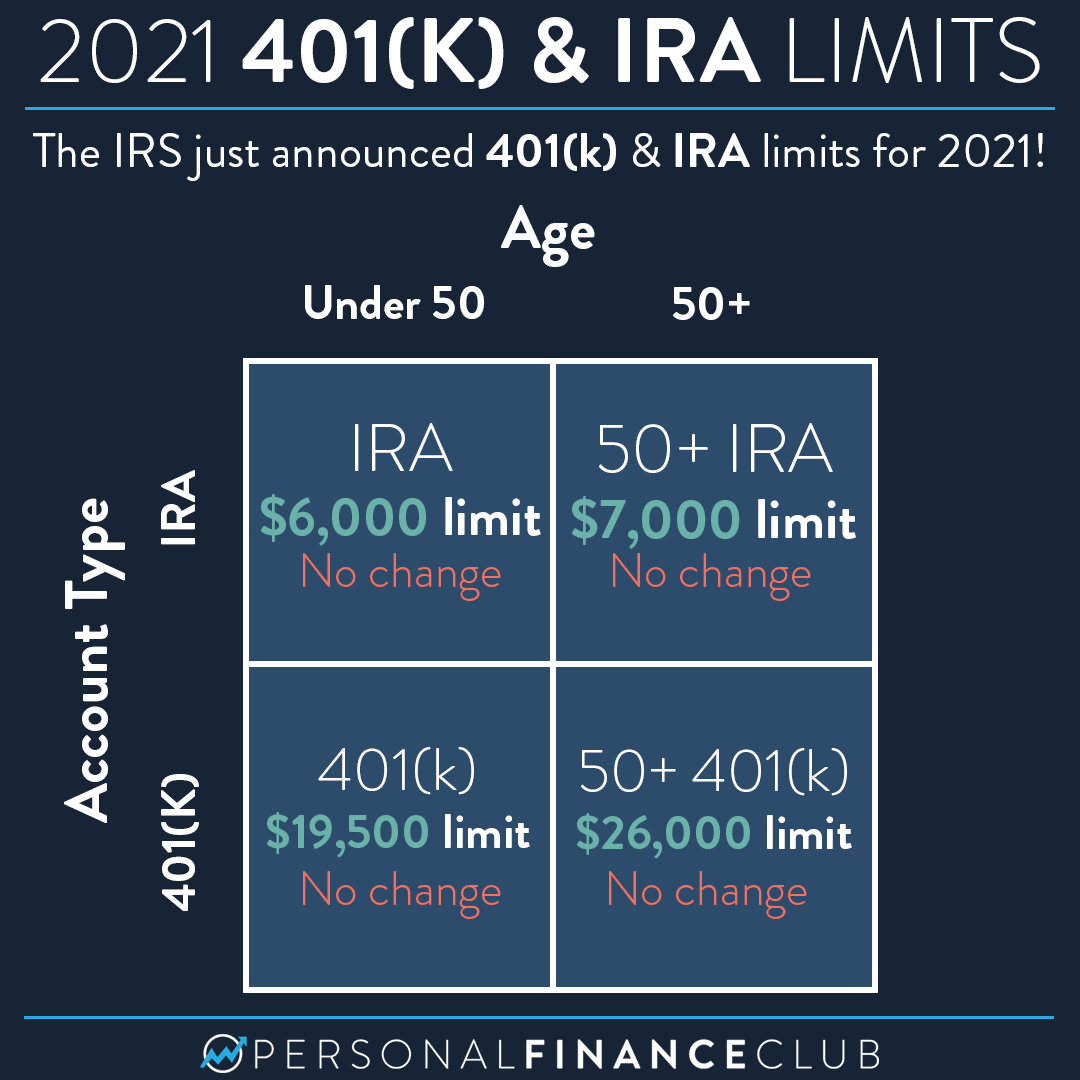

A One-Stop Option That Fits Your Retirement Timeline. 2021 Maximum Contribution Limits for High Earners. For 2021 your individual 401 k contribution limit is 19500 or 26000 if youre age 50 or older.

In addition the amount of your compensation that can be taken. For those age 49 and under the limit is 61000 in 2022 up from 58000 in 2021. Ad Discover The Benefits Of A Traditional IRA.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Specifically you are allowed to make. The maximum 401k contribution changes from year to year.

The IRA contribution limits are below. 8 Sticking with our example above maxing out your Roth. SIMPLE 401 k - A SIMPLE 401 k plan is.

An employee contribution of for An employer. However for 2022 the IRS raised this limit by 1000 making it 20500. For 2022 the 401k limit for employee salary deferrals is 20500 which is above the 401k 2021 limit of 19500.

In 2021 you can put up to 6000 into a Roth IRA and an extra 1000 catch-up contribution if youre age 50 or older. Also a fixed periodical amount will be invested in the 401 k Contribution which would be a maximum of 19000 per year. If you are 50 years old or older the maximum contribution limit went from 63500 in 2020 to 64500 in.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. This limit is 305000 in 2022 290000 in 2021. Also this limit is for your total contribution to 401 k plans.

The maximum limit went from 57000 in 2020 to 58000 in 2021. While limits for employee pre-tax contributions increased by 500 from 2019 to 2020 the limits remain steady for 2021 at. In 2022 401 k contribution limits for individuals are 20500 or 27000 if.

A 401 k can be one of your best tools for creating a secure retirement. Consider a defined benefit plan if you want to contribute more than the 2022 Individual 401k contribution limit of 61000. Learn About 2021 Contribution Limits Today.

A limit applies to the amount of annual compensation you can take into account for determining retirement plan contributions. A 401k plan and a profit sharing plan can be combined with a. IRAs include catch-up contributions similar to 401k 403b and 457 plans.

New Look At Your Financial Strategy. Visit The Official Edward Jones Site. Learn About 2021 Contribution Limits Today.

IR-2021-216 November 4 2021. In 2022 the contribution limit was raised from 58000 in 2021 to 61000 with 6500 for catch-up contributors 50 years or older. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit.

Employees can contribute up to 19500 to their 401 k plan for 2021 and 20500 for 2022. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer. Employees 50 or over can make an additional catch-up contribution of 6500.

Ad Manage Your Investments or TIAA Can Help with Professional Investment Advice. A catch-up contribution is a payment only taxpayers ages 50. In 2021 the basic contribution limit was 19500.

There is an upper limit to the combined amount you and your employer can contribute to defined 401 ks. Employer matches dont count toward this limit and can be. In 2021 the basic contribution limit was 19500.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. However for 2022 the IRS raised this limit by 1000. WASHINGTON The Internal Revenue Service announced today that the amount individuals can contribute to their 401 k plans in 2022 has.

This limit increases to 67500 for 2022 64500 for 2021 63500 for 2020 if you include catch-up contributions. Anyone age 50 or over is eligible for an additional catch-up.

Employer 401 K Maximum Contribution Limit 2021 38 500

The Maximum 401k Contribution Limit Financial Samurai

How Much Can I Contribute To My Self Employed 401k Plan

Retirement Calculator 401k Clearance 58 Off Www Ingeniovirtual Com

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

The Maximum 401 K Contribution Limit For 2021

New 2023 Irs Retirement Plan Contribution Limits Including 401k Ira White Coat Investor

401k Contribution Limits And Rules 401k Investing Money How To Plan

After Tax 401 K Contributions Retirement Benefits Fidelity

Solo 401k Contribution Limits And Types

Free 401k Calculator For Excel Calculate Your 401k Savings

The Maximum 401k Contribution Limit Financial Samurai

Solo 401k Contribution Limits And Types

2021 Contribution Limits For 401 K And Ira Personal Finance Club

How Much Should People Have Saved In Their 401ks At Different Ages See More At Http Www Financialsamura Saving For Retirement 401k Chart Finance Education

-savings-detailed.png)

Retirement Calculator 401k Discount 50 Off Www Ingeniovirtual Com